German Crisis Troubles Dependent CEE Countries | Challenges for Regional Ratings | EU Eyes Space Project IRIS

In this week’s edition you’ll read about:

Why the Industrial Crisis in Germany Worries Countries Eastern of Its Borders.

The Risks Looming Over the Credit Ratings of the CEE Countries.

How Europe Plans to Build Its Space Satelite Constellation.

CEE Countries Depend on the German Industry. Now They See It Crumble

Germany faces weeks of political paralysis after Chancellor Olaf Scholz lost a confidence vote in the Bundestag on Tuesday, triggering snap elections in February. The political vacuum in Europe’s largest economy couldn’t come at a worse time.

Donald Trump’s return to the White House looms large, threatening to shake Germany and the broader EU. A shift in U.S. policy could jeopardize military support for Ukraine and bring tariffs that would hit German exporters hard, further straining an already fragile economy.

Once an industrial powerhouse built on cutting-edge production, Germany's automotive industry now faces a lack of investment and fierce competition from China, which is nearing the production of nearly every other car globally.

Mounting market and structural pressures have forced Volkswagen, Germany's largest automaker, to consider closing factories and cutting wages. These restructuring efforts have brought the company into conflict with its workforce over potential factory closures heading into the new year. While the fifth round of negotiations began on Monday, both sides remain at a deadlock, with talks possibly spilling over into 2025.

Suppliers are also feeling the pressure as cracks in Germany's economic model begin to show.

Bosch, the world’s largest automotive supplier, has been hit by weak demand, rising competition from China, and a slow transition to electric vehicles. The company now expects to cut up to 10,000 more jobs at its German plants than previously anticipated.

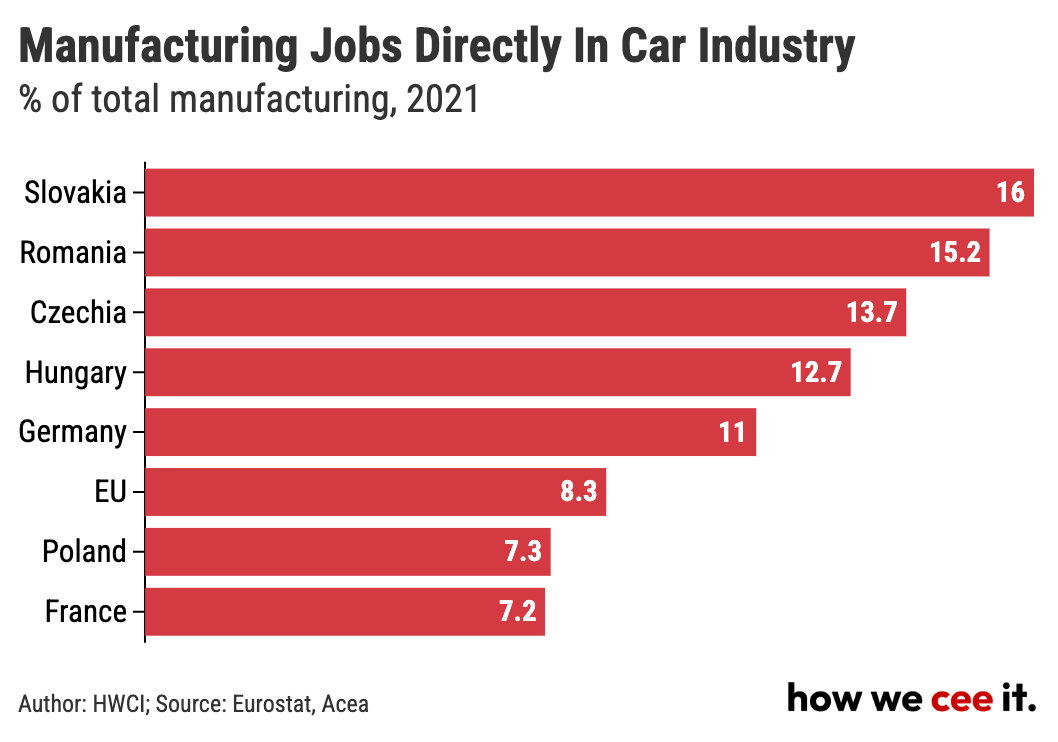

Developments in Germany are being closely watched across Central and Eastern Europe, where many economies are tightly linked to its automotive industry.

The Czech Republic, for instance, is particularly exposed, with 30% of its exports bound for Germany. Car production, which accounts for 9% of the Czech GDP, is deeply tied to Germany through Škoda Auto, a key part of the Volkswagen Group.

For Slovakia—the world’s largest car producer per capita—Germany is also the most important trade partner, with over a fifth of its exports heading there. The Volkswagen plant in Bratislava, employing more than 11,000 people, is the country’s largest company.

In Romania, Germany accounts for 21% of total exports. Vehicles represent the country’s second-largest export sector and make up approximately 13% of the GDP.

Poland, too, relies heavily on Germany, which takes 28% of its exports. The automotive sector contributes 8% of Poland’s GDP and about 13.5% of export value. Volkswagen also operates a major manufacturing plant in Poznań.

The Hungarian automobile industry produces about 4% of GDP, with Audi (belonging to VW), Mercedes-Benz, and Opel belonging to German manufacturers.

Central and Eastern European Ratings Outlook Is Stable, but Geopolitical and Fiscal Challenges Loom

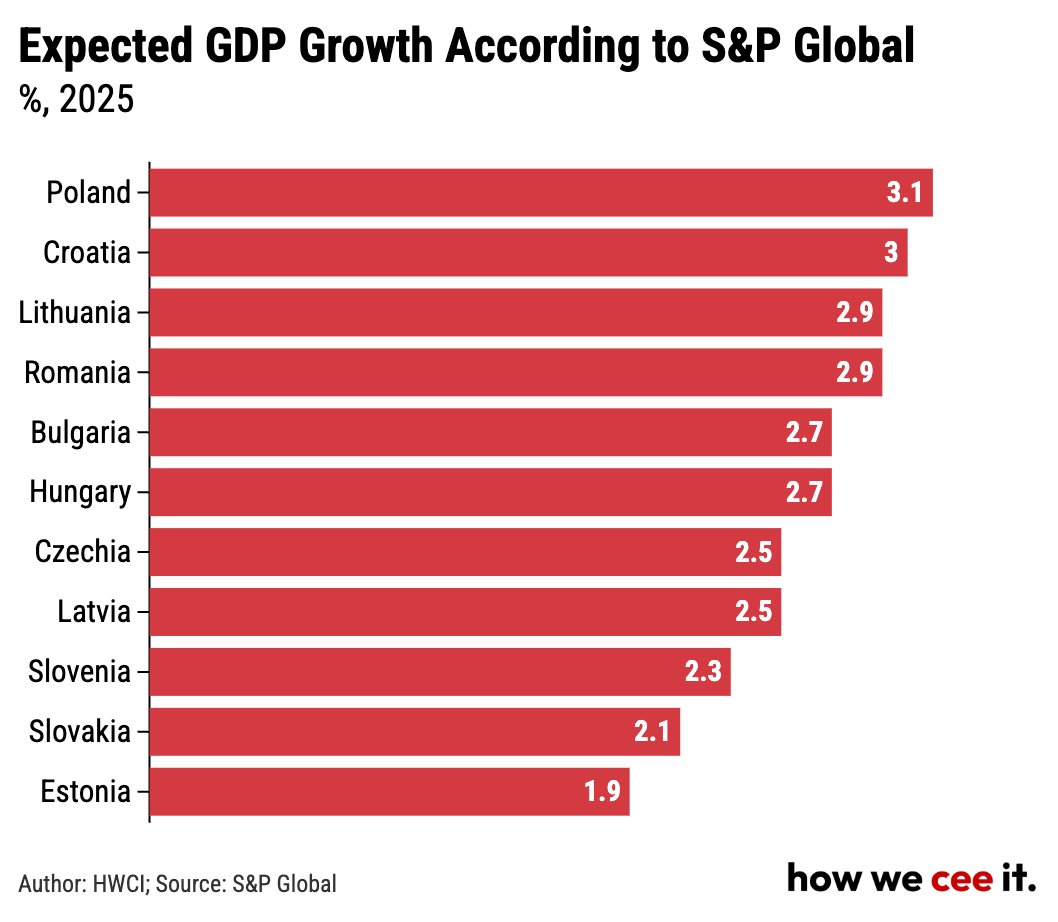

S&P Global has released its 2025 outlook for Central and Eastern Europe (CEE) sovereign ratings, noting that most ratings carry a “stable outlook”. Expectations of stronger GDP growth, controlled balance-of-payment risks, disinflation, monetary easing, and moderate government debt support this stability.

The ratings are important, as they influence governments' borrowing costs.

Despite a stable outlook, the report highlights several key risks that could negatively impact them:

Weaker GDP growth among key trading partners, particularly Germany, due to trade tensions and geopolitical uncertainty.

Rising geopolitical tensions, including reduced U.S. NATO support and the ongoing Russia-Ukraine war, weigh on business confidence.

Fiscal challenges stemming from high deficits, slower growth, and rising defense costs, all of which could worsen financing conditions.

Delayed EU fund absorption and Monetary policy missteps.

Slovakia has already seen a downgrade in its rating from another agency—Moody’s—on Friday. Moody's cited a series of reforms introduced by Robert Fico's government since taking office last year as a key driver. Notably, extensive changes to the judiciary and media have sparked public protests and raised concerns within the European Commission.

Europe’s €10.6 Billion Bet on Space: Meet IRIS²

The EU has officially signed contracts worth €10.6 billion to develop its own satellite constellation, IRIS². Set to launch 290 satellites by 2030, the project aims to secure high-speed, resilient communications for Europe while reducing reliance on foreign networks like Starlink.

Sound familiar?

Just last week, we covered Project Bromo, Europe’s ambitious plan to rival Starlink with its own satellite networks. IRIS² builds on this same theme: a broader push for strategic autonomy. Europe is no longer content to rely on global competitors—be it in space communications or advanced tech infrastructure.

Why it matters for CEE:

For Central and Eastern Europe, IRIS² and Project Bromo could mean better digital access, stronger defense capabilities, and a chance to drive innovation in the region. It also signals Europe’s growing commitment to staying competitive in the global tech and space race.

These projects are not isolated—they’re pieces of the same puzzle: Europe ensuring it’s ready to stand tall in a rapidly changing, tech-driven world.

Sidenotes:

Slovakia and Hungary vetoed the EU's efforts on Monday to impose sanctions on leaders of Georgia's pro-Russian government, who have been accused of using severe violence against civilians. The move comes amid mass protests, with tens of thousands of Georgians taking to the streets after the ruling "Georgian Dream" party suspended EU accession talks.

As China weaponizes its drone parts supply chain against Ukraine, Kyiv is ramping up domestic production of spare parts to strengthen its defense capabilities.

Austrian energy company OMV has terminated its contracts with Gazprom, one of Russia's key revenue-generating assets for the war. OMV officials cited "fundamental breaches of contract" as the reason for cutting ties.